Dubai’s skyline is a biography of success, written in glass and steel. But between the glittering towers, if you know where to look, are the unbuilt chapters—the ghostly outlines of mega-projects that promised to redefine the world, only to vanish into the desert air.

They are the shadow side of the city’s “build it and they will come” ethos. While everyone loves to celebrate the triumphs like the Palm or the Burj Khalifa, the true education for an investor lies in studying the failures: The Universe archipelago, The Dubai Pearl, The Trump International Golf Club Oman (Dubai-linked).

Their stories reveal not a weakness in the Dubai model, but its brutal, Darwinian rules for survival. A mega-project failure here isn’t a random accident; it’s a forensic lesson in what happens when ambition outruns physics, finance, and fundamental demand.

The Anatomy of a Failure: How the Dream Unravels

The demise of a mega-project follows a predictable, painful script. It’s rarely one cause, but a toxic cocktail of them:

-

The Fatal Flaw: Misreading the Market. The most common killer. A project is conceived in isolation, based on ego or a “field of dreams” belief, rather than demonstrable demand.

The Universe islands, announced at the peak of 2008 mania, offered little beyond the novelty of celestial shapes in the sea—a novelty that proved insufficient to attract the billions needed for development in a post-crisis world. The market voted with its wallet: no sale.

-

The Financial House of Cards. Many failed projects were built on leveraged debt and pre-sales, with no deep-pocketed anchor investor.

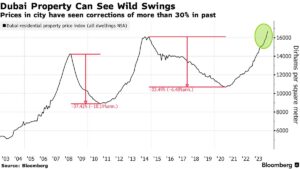

When the 2008 financial tsunami hit, funding evaporated overnight. Buyers defaulted on installments, and developers, lacking cash reserves, entered a death spiral of frozen construction, lawsuits, and eroding confidence.

Without a government or sovereign backstop, collapse was inevitable.

-

The Over-Complexity Trap. Some projects were simply too ambitious from an engineering or regulatory standpoint.

Endless delays, cost overruns, and technical nightmares sap investor confidence. Buyers lose faith and walk away, triggering termination clauses and refund demands the developer cannot meet.

-

The “Anchor Tenant” Mirage. Some projects hinged on a major brand or institution that never materialized. When the promised “world’s first” museum or flagship university fails to sign, the entire commercial rationale for the surrounding residential and retail units evaporates.

The Fallout: The Ripple Effect of Collapse

When a mega-project fails, the damage radiates far beyond the developer’s balance sheet.

-

For Investors & Off-Plan Buyers: This is the ground zero of financial loss. Their capital is trapped, often for years, in legal limbo.

They face a agonizing choice: sue for a refund from an insolvent entity (costly and slow) or wait indefinitely for a white-knight takeover.

Their investment is frozen, illiquid, and potentially worthless. The psychological blow erodes trust in the entire off-plan market.

-

For the Surrounding Area: A failed mega-project isn’t neutral; it’s a blight. It becomes a fenced-off scar on the urban fabric, dragging down the appeal and property values of neighboring, completed communities.

Promised infrastructure (roads, metro links) is delayed or canceled, stifling growth for the entire district.

-

For the Market’s Reputation: Each failure is a gift to Dubai’s detractors. It fuels the “desert mirage” narrative and makes international institutional investors more cautious, potentially raising the cost of capital for all future projects.

-

For the Ecosystem: Sub-contractors and consultants go unpaid. Banks write off bad loans. The legal system is clogged with cases. It’s a systemic shock that takes years to absorb.

The Modern Safeguards: Why 2008 Won’t Repeat (Exactly)

Crucially, Dubai learned. The regulatory landscape post-2008 was transformed to make a cascading failure of this scale less likely:

-

Escrow Law: The most important change. All off-plan payments must now be held in a protected escrow account, directly linked to construction milestones. Developers cannot use Buyer A’s money to fund marketing for Project B. This prevents Ponzi-style schemes and ensures funds exist to complete the project.

-

RERA’s Iron Fist: The Real Estate Regulatory Agency now pre-approves all project launches, marketing materials, and payment plans. Developer credentials and financial viability are scrutinized. Misleading advertising is punished.

-

The Rise of the Sovereign-Backed Developer: The market is now dominated by giants like Emaar, Nakheel (backed by Dubai World), and Meraas (backed by Dubai Holding). Their projects are effectively underwritten by the state, making catastrophic, walk-away failure almost unthinkable. They have the balance sheets to weather storms and complete projects.

The Investor’s Survival Guide: How to Spot a Future Ghost

The safeguards are strong, but vigilance is non-negotiable. Before investing in any mega-project, ask:

-

Who is the Developer? Is it a listed, tier-1 developer with a decade-long track record of delivery (Emaar, Nakheel, DAMAC), or an unknown private vehicle?

-

What is the “Why”? Does the project solve a genuine market need, or is it just a spectacular concept? Is there demonstrable demand for 40,000 ultra-luxury units, or is it creating supply for a non-existent buyer?

-

Follow the Money: Is the project funded by substantial equity from the developer or a sovereign fund, or is it 100% reliant on off-plan sales to begin construction?

-

Check the RERA Card: Verify the project’s RERA registration and escrow account number. Never pay a dirham into any account not officially registered and published by RERA.

The Final Verdict: Ambition, Now with a Safety Net

Mega-project failures in Dubai are not evidence of a flawed city, but of a market that now has a mature immune system. They are the necessary scars from its adolescent growth spurt. Today, the combination of draconian regulation, sovereign-backed developers, and a more sophisticated buyer base has created a environment where failure is now more likely to be a slow-motion fizzle of delays and downsizing than a sudden, catastrophic collapse.

The cautionary tale is no longer “don’t invest in Dubai.” It’s far more specific: “Don’t invest in unproven developers with fantastical concepts and unclear funding, no matter how dazzling the renders.” The desert still rewards the bold, but it now mercilessly buries the reckless. Your job is to know the difference.

Navigating the promise and peril of mega-projects requires more than a brochure. It requires forensic-level due diligence on the developer, the funding, and the underlying market demand.

Our firm conducts independent deep-dive analyses on major project launches. To receive our due diligence framework and reports on current market offerings, request our investor toolkit.

👉 Access the Mega-Project Due Diligence Toolkit