You’ve heard the stories. The off-market penthouse on the Palm that sold for AED 200 million, never touching a public listing.

The prime plot in the DIFC that changed hands between two unknown entities based in the DIFC itself. The luxury villa that was quietly acquired, renovated, and flipped for a 40% profit, all before the “For Sale” sign went up in the neighborhood.

To the casual observer, Dubai’s ultra-prime real estate market seems driven by public listings, flashy brokerages, and property portals. But those in the know understand this is merely the surface show. Beneath it operates a highly discreet, invitation-only ecosystem—a “secret society” of family offices, sovereign-backed entities, and a handful of elite brokerages that control the flow of the city’s most coveted assets.

This isn’t a conspiracy; it’s the logical outcome of extreme wealth seeking privacy, speed, and exclusivity.

The Members of the “Society”

This ecosystem isn’t a single club, but a network of interconnected nodes, each serving a specific function in the shadow market.

-

The Capital: Global Family Offices & Sovereign Wealth Affiliates

This is the bedrock. The buyers and sellers are often not individuals, but the Dubai-based outposts of global family offices (from Europe, Asia, the CIS) and investment vehicles linked to regional sovereign wealth.They don’t browse property portals. They have specific mandates: to acquire “trophy assets” for wealth preservation or to discreetly rotate capital out of one asset class into another.

Their transactions are not about mortgages or emotional purchases; they are strategic portfolio moves executed with confidentiality as the highest priority.

-

The Gatekeepers: The “Ultra-Prime” Brokerage Firms

A tiny fraction of Dubai’s thousands of agents operate in this stratum. These are not high-street agencies.They are boutique firms, often headed by a single well-connected principal with decades of relationships in the Gulf. Their “office” is a network of WhatsApp groups, private dinners, and members-only clubs.

They don’t advertise listings; they curate them for a vetted clientele. Their value isn’t in marketing, but in access, discretion, and the ability to structure complex, cross-border deals.

-

The Enablers: Private Banks & Legal Architects

The transactions are facilitated by private bankers from institutions like Julius Baer, UBS, and Goldman Sachs, who introduce clients to opportunities.They work in tandem with a small circle of law firms specializing in family office structuring, tax-efficient holding vehicles (often in the DIFC or ADGM), and multi-jurisdictional inheritance planning. The property purchase is just one line item in a much larger wealth strategy.

-

The Inventory: The “Shadow Stock” of Off-Market Assets

The “secret society” controls a persistent shadow inventory of properties that never see the light of the public market. These are assets held within portfolios that may be rotated internally or sold via a single, discreet phone call. This system exists because for UHNWIs, public exposure is a liability—it can invite scrutiny, unsolicited offers, or even security concerns.

How the System Really Works: A Silent Transaction

Here’s how a typical AED 100M+ deal flows in this world:

-

The Genesis: A family office decides to liquidate a Dubai asset to fund an opportunity elsewhere. They call their trusted broker or private banker.

-

The Silent Market: The broker immediately knows 2-3 potential buyers from their own rolodex who have expressed interest in that exact building or community. An off-market “teaser” is sent without an address, just key details.

-

The Viewing & Negotiation: If interest is secured, viewings are arranged at obscure times, often with non-disclosure agreements signed beforehand. Negotiations happen directly between principals or their representatives, bypassing public haggling.

-

The Closing: The deal is structured through a corporate vehicle, often with the property ownership held by a special purpose vehicle (SPV) company rather than an individual’s name. The transfer happens at the DLD, but the public records show a company name, not a person.

The “Why”: Privacy, Speed, and Price Control

This parallel system thrives for undeniable reasons:

-

Absolute Privacy: Protects the identity and holdings of high-profile individuals.

-

Superior Pricing: Sellers avoid the price-depressing effect of a stale public listing. Buyers avoid bidding wars. The “right” price is found in private.

-

Exclusive Access: Buyers get first look at generational assets. Sellers access only qualified, serious capital.

-

Efficiency: Deals are done in weeks, not months, with minimal fuss.

Can You Join? The Reality Check

For 99.9% of investors, this world is inaccessible by design. You don’t apply. You are invited. The invitation is earned through:

-

Proving Your Capital: Consistently transacting in the AED 50M+ range through conventional channels.

-

Building Trust: Working with the right lawyers and private bankers who can provide references.

-

Demonstrating Discretion: Having a reputation for being a serious, quiet counterparty.

The Bottom Line: Two Parallel Markets

Dubai doesn’t have one real estate market; it has two. The public market—vibrant, transparent, and accessible—is where 95% of activity occurs.

The private, ultra-prime market—opaque, clubby, and driven by institutional capital—controls the destiny of the city’s most symbolic and valuable assets.

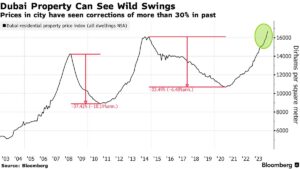

Understanding this duality is crucial. It explains why prime property prices can surge based on invisible demand.

It reveals why the best opportunities are never advertised. And for the aspiring investor, it delineates the summit: a place where real estate ceases to be about property and becomes purely about the management of global capital.

The “secret society” doesn’t control Dubai’s properties; it controls the commanding heights of its wealth landscape.

Gaining strategic insight into market movements at this level requires intelligence that goes beyond public data. Our consultancy provides nuanced analysis on capital flows and ultra-prime trends to inform your broader investment strategy.

👉 Request our quarterly Ultra-Prime Market Pulse Report for institutional-level insights.