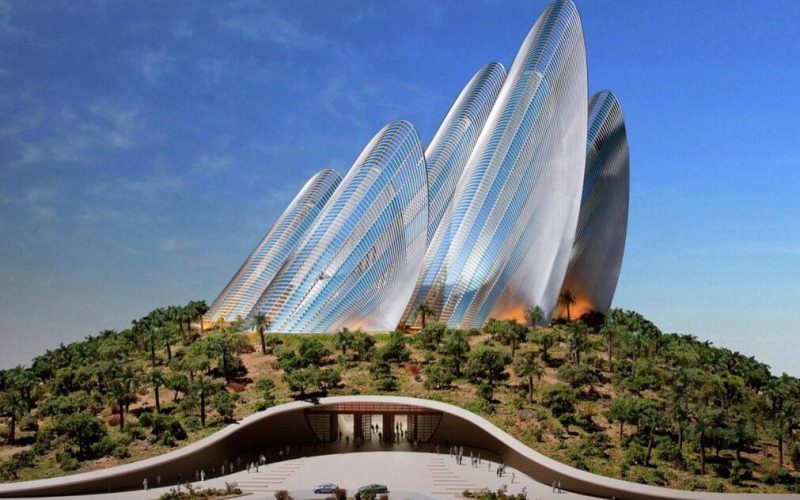

Forget everything you thought you knew about Abu Dhabi’s real estate market. While analysts were watching oil prices and office vacancy rates, a seismic shift was quietly being built on the sands of Saadiyat Island. The December 3rd grand opening of the Zayed National Museum isn’t just a cultural milestone—it’s the final, masterful stroke in a trillion-dirham strategy to reposition Abu Dhabi as the undisputed cultural heart of the Gulf. And for savvy investors, it just lit a fuse.

This isn’t hyperbole. The inauguration of the UAE’s national museum—a breathtaking architectural feat chronicling the legacy of the nation’s founding father—completes a “Cultural Trinity” on Saadiyat Island alongside the Louvre Abu Dhabi and the upcoming Guggenheim Abu Dhabi. This creates a gravitational pull for a specific, high-value demographic that every luxury real estate market in the world craves.

Why This “Soft Power” Move is a Hard Real Estate Catalyst

Luxury property isn’t sold on square footage alone; it’s sold on a story, a lifestyle, and an identity. The Zayed National Museum provides the most powerful narrative of all: national identity and heritage.

-

The “Bilbao Effect” on Steroids: When the Guggenheim Museum opened in Bilbao, Spain, it transformed a declining industrial city into a global tourism and business destination, boosting the local economy and property values exponentially. Abu Dhabi has executed this on a master-planned scale. Saadiyat Island is no longer a collection of future blueprints; it is now a delivered, world-class cultural district. This permanence erases perceived investment risk.

-

Attracting the “Cultural Capital” Class: The ultra-wealthy are no longer drawn solely to flashy skylines and marinas. The new global elite seeks cultural enrichment, education, and a connection to place. The museum, dedicated to Sheikh Zayed’s values of sustainability and knowledge, attracts exactly this demographic: legacy families, academics, diplomats, and CEOs who choose where to live based on the quality of a city’s institutions. These are long-term, stable residents and buyers.

-

The Ultimate Amenity: For premium developments like Saadiyat Grove, Mamsha Al Saadiyat, and The Mayan, the museum isn’t just a nearby building—it’s the centerpiece of their backyard. Marketing shifts from “near future museums” to “overlooking the iconic Zayed National Museum.” This grants an irreplicable prestige premium that competing luxury communities in the region simply cannot match.

The Investment Implications: What Changes Now?

The opening moves Saadiyat Island from the “promise” phase to the “proven” phase. Here’s what that means on the ground:

-

Rental Demand & Tenant Profile: Expect a surge in demand from high-net-worth expatriates and regional families specifically seeking a “cultural lifestyle.” Rental yields for high-end villas and apartments should see strengthening support.

-

Capital Appreciation Floor: The billions invested in permanent global institutions (Louvre, Zayed Museum, Guggenheim) create a tangible “value floor” for the island’s real estate. The asset class is now underwritten by more than market sentiment; it’s backed by sovereign-level cultural investment.

-

Secondary Market Momentum: Off-plan sales have driven Saadiyat for years. Now, the secondary (ready) property market becomes significantly more attractive, as buyers can immediately experience the complete cultural ecosystem. This increases liquidity and transaction diversity.

-

The “Spillover Effect” to Mainland Abu Dhabi: The halo of the Cultural District elevates the entire city’s global profile. Corridors with easy access to Saadiyat Island, like Al Reem Island and Al Maryah Island, will benefit from the increased attention and rising tide of prestige.

A Warning for the Hesitant Investor

There is a predictable cycle to watershed moments like this:

-

Announcement & Skepticism (“Will it ever open?”)

-

Opening & Validation (The “oh, they were serious” moment—WE ARE HERE).

-

Price Adjustment (The market recalibrates to reflect the new, enhanced value proposition).

-

Sustainable Premium (The new norm is established).

To wait on the sidelines now, after the doors have literally opened, is to risk buying in during Phase 3 rather than capitalizing on the Phase 2 shift.

The Bottom Line

The Zayed National Museum is more than a tribute to the past; it is the key to Abu Dhabi’s future—a future meticulously crafted to attract and retain the world’s most valuable citizens and capital. In real estate, the greatest returns are captured by those who recognize a paradigm shift before it’s fully priced in.

The opening ceremony is over. The signal to the market is clear. The question is no longer if this will impact Abu Dhabi’s luxury real estate landscape, but how significantly and how quickly.

The opening of the Zayed National Museum changes the fundamental calculus for investing in Saadiyat Island and Abu Dhabi. Don’t rely on outdated market reports.

Our team has prepared a proprietary analysis, “The Post-Museum Premium: A Saadiyat Island Investment Update,” detailing immediate opportunities and projected value trajectories.

👉 Click here to download the exclusive briefing.