For a generation told they could have it all, the reality of Dubai’s 2025 property market feels like a mirage shimmering just out of reach. Millennials—those roughly aged 28 to 43—came of age during the city’s explosive growth, dreaming of a penthouse view or a villa with a pool.

Today, that dream is colliding with a brutal economic equation: soaring prices, stagnant wages, and a market that has fundamentally shifted. They are not just being outbid; they are being structurally excluded from the traditional path to homeownership. But this isn’t a story of surrender.

It’s a story of radical adaptation, where an entire generation is rewriting the rulebook on how to build wealth and secure a life in one of the world’s most dynamic cities.

The Triple Lock Squeeze: Why the Door is Closing

-

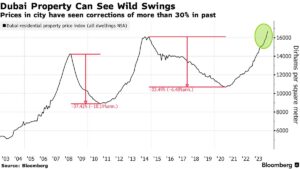

The Astronomical Price Surge: Since the post-pandemic rebound, prime property prices have surged over 50% in some segments. A studio in a desirable area like Dubai Marina or Business Bay that once cost AED 600,000 may now be AED 1M+.

The 20% down payment—the golden ticket to a mortgage—has moved from AED 120,000 to over AED 200,000, a sum that feels insurmountable while renting at AED 50,000+ per year.

-

The Mortgage Math That Doesn’t Add Up: UAE Central Bank rules cap mortgage payments at 50% of a borrower’s monthly income.

With high rents consuming 30-40% of a millennial’s salary, qualifying for a mortgage on a meaningful property becomes a near-impossible financial puzzle. The bank’s valuation, not the market price, dictates the loan, creating a constant shortfall.

-

The Investor-Fueled Market: Millennials aren’t competing with each other. They’re competing with global cash buyers, institutional funds, and wealthy investors for whom a AED 3M apartment is a portfolio diversifier, not a life-altering purchase.

This has detached prices from local salary scales, creating an asset market, not a housing market.

The Millennial Playbook: 5 Radical Strategies to Fight Back

Faced with this, millennials aren’t waiting for a crash. They are deploying ingenious, collaborative, and tech-savvy tactics to claim their stake.

1. The “Rentvesting” Revolution:

This is the number one strategy. Instead of trying to buy where they want to live, they buy where they can afford as an investment, and rent where they want to live.

A millennial might purchase a studio in Jumeirah Village Circle (JVC) or a 1-bed in Arjan for AED 800K, rent it out to cover the mortgage, and use the rental income to subsidize their own rent in a more central, walkable location like Downtown or the Marina. They build equity in an asset while enjoying the lifestyle they want.

2. The “Co-Buying” Collective:

Inspired by models in expensive cities like London and Sydney, friends or siblings are pooling resources to buy together. Two or three millennials form a legal partnership (often through a jointly owned company) to afford a 2- or 3-bedroom apartment.

This splits the down payment, mortgage, and service charges, making entry possible. It requires airtight legal agreements but unlocks otherwise impossible opportunities.

3. The “House Hacking” Hustle:

This old strategy is seeing a Dubai revival. A millennial buys the most affordable 2-bedroom apartment they can find, often in an emerging community like Dubailand or Dubailand Residence Complex (DRC).

They live in one room and rent out the other(s). The rental income from the roommates can cover 70-100% of the mortgage, allowing them to live for minimal cost and build equity aggressively.

4. The “Location Sacrifice” for Future Gain:

They are abandoning the core, glamorous districts for the next frontiers of growth. Areas like Dubai South (near the new Al Maktoum Airport), Dubai Hills Estate (for more space), or even parts of Sharjah bordering Dubai offer significantly lower entry points.

They are betting on infrastructure projects and city expansion to drive future value, accepting a longer commute now for potential wealth later.

5. The “Digital Nomad” End-Around:

Leveraging Dubai’s virtual working program and freelance visas, they are decoupling their income from the local salary scale. By earning in stronger foreign currencies (USD, EUR, GBP) from remote clients, they regain purchasing power and can qualify for larger mortgages based on a higher, documented income stream.

The Silent Shift: Redefining the “Dubai Dream”

The most profound change is psychological. The millennial “Dubai Dream” is no longer a standalone villa with a Mercedes in the driveway on day one. It is:

-

A Portfolio, Not a Palace: Wealth is seen as a collection of assets (a rental property, crypto, side-business equity) rather than a single, perfect home.

-

Flexibility Over Permanence: The commitment of a 25-year mortgage is daunting. Strategies like rentvesting offer optionality and mobility.

-

Community and Experience Over Square Footage: Spending is prioritized on experiences, travel, and wellness, with housing seen more as a functional base. This fuels the demand for vibrant, amenity-rich rental communities.

The Bottom Line: Not Priced Out, Just Priced Differently

Millennials are not leaving the game; they are changing it. They are using financial technology, collective models, and global income streams to hack a system that wasn’t built for them.

The era of the single, salaried individual buying a downtown apartment on a 5-year plan is over for most.

Their path is harder, more collaborative, and requires more financial sophistication. But it is forging a generation of investors who understand leverage, cash flow, and asset diversification better than any before.

They may not own the penthouse, but they are building the foundation to own the building next door.

This new playbook requires a new kind of advisor—one who understands fractional ownership, investment yield analysis, and cross-border income structuring.

Our consultancy specializes in building these non-traditional wealth pathways for millennials in the UAE market. Book a strategy session to map your personalized approach.

👉 Book a Millennial Wealth Pathway Session