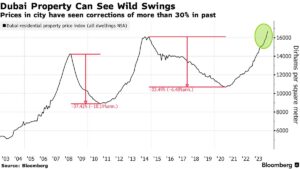

It’s the most seductive pitch in Dubai real estate: buy today’s price for tomorrow’s dream. Glossy renderings show sparkling towers, tranquil lagoons, and a lifestyle of unimaginable luxury.

The payment plan is irresistible—just 1% a month, with 70% due only on completion. You’re not just buying a property; you’re buying a vision of your future wealth, at a discount to the “future market.”

This is the powerful allure of off-plan property, and it remains one of the most legitimate paths to building equity in Dubai.

But woven into this legitimate market is a toxic, persistent strand: the deliberate, structural scam that continues to separate unwary investors, especially from overseas, from their life savings. This isn’t about market risk; it’s about fraud by design.

The Anatomy of the Modern Off-Plan Scam: “Project X”

Let’s dissect how it works, using a hypothetical but agonizingly common example, “Project X – The Oasis Tower.”

Phase 1: The Illusion of Legitimacy (The Bait)

-

The Front: The developer is a “new, dynamic” company, often with a name that sounds established. They secure a plot of land in a known area (e.g., Dubailand). This is the single legitimate part of the entire operation, used to confer credibility.

-

The Renders & Marketing: They hire a top-tier architectural visualization firm. The renders are stunning. The brochure speaks of “world-class amenities,” “guaranteed rental yields,” and “exclusive access.” They launch at a glittering event in a hotel, often in the investor’s home country, with sales agents fluent in the local language.

-

The “Regulatory” Smokescreen: They will claim to be “registered with the DLD” and may even have a project registration number. What they don’t explain is the difference between registering a project and having fully compliant, trustee-held escrow accounts for each unit.

Phase 2: The Irresistible Offer (The Hook)

-

The Pricing: “Project X” is priced 20% below comparable finished properties in the area. The discount is explained as an “early bird advantage.”

-

The Payment Plan: It’s engineered for low friction: 5% down, 5% during construction, and 90% on handover. This feels safe. Why would they build if they only get 10% of my money?

-

The False Security: They provide a sales and purchase agreement (SPA). To an untrained eye, it looks official. It may even reference RERA. But buried in the clauses are terms that allow for indefinite delays, specification changes, and, crucially, pooled escrow—not the unit-linked escrow required by law.

Phase 3: The Slow Fade (The Scam)

-

The “Breaking Ground” Ceremony: A photo op with a shovel occurs. Construction appears to start. Initial installments are collected.

-

The Slowdown: Updates become less frequent. Excuses begin: “permitting delays,” “supply chain issues.”

-

The Radio Silence: The sales agents stop returning calls. The website goes dark. The plot of land sits abandoned, a concrete stump or a bare foundation as the only monument to the investment.

-

The Devastating Truth: The developer has legally absconded with the initial payments. Because the funds were not in the proper, unit-specific RERA escrow account mandated by the UAE’s Escrow Law (Law No. 8 of 2007), they were used for marketing, salaries, or simply withdrawn. The “company” is a shell. The investors’ money is gone. The project never had the financing to complete.

The Red Flags No Sales Agent Will Ever Point Out

-

The “Guaranteed Return” or “Rental Yield” Promise: This is the hallmark of a scam. No legitimate developer can guarantee future market rents. It is illegal under RERA regulations. It’s a fantasy used to shut down your critical thinking.

-

Pressure to Sign NOW: “This price is only for today.” “Only two units left at this rate.” High-pressure tactics are designed to bypass due diligence.

-

Vague or Non-Existent Escrow Details: You must receive, in writing, the official RERA Escrow Account Number for your specific unit. If they say “the funds are safe with our company account” or provide a generic account, run.

-

The Unknown Developer: A quick check on the DLD’s Dubai REST app or the RERA website will reveal their track record. No completed projects? Only one project? Extreme danger.

-

The Offshore Sales Pitch: Being sold the property exclusively from abroad, with no easy way to visit the sales office or developer HQ in Dubai, is a massive risk amplifier.

Your Anti-Scam Due Diligence Checklist

Before signing anything, you must complete this list:

-

✅ Verify the Developer: Go to the official RERA website (www.rera.ae) or use the Dubai REST app. Search the developer by name. Check their “Developer Classification.” Is it a “Grade A” or “Grade B” developer with a list of delivered projects?

-

✅ Demand the Unit-Specific Escrow Details: The SPA must state the official RERA Escrow Account number. Cross-check this number on the RERA website. Your payments must be made only to this account, via traceable bank transfer.

-

✅ Read the SPA with a Lawyer: Not your cousin who “knows about contracts.” Hire a UAE-based real estate lawyer (cost: ~AED 5,000-10,000). They will spot unenforceable clauses, illegal guarantees, and termination loopholes. This is the single best investment you will make.

-

✅ Visit the Site & Sales Office in Dubai: If you can’t, hire a trusted local contact to do it. A legitimate developer has a permanent, professional sales office in Dubai.

-

✅ Ignore the Renders, Research the Land: Use Google Earth to look at the plot. Is it empty desert? Is it accessible? What’s around it? Ground truth beats glossy fantasies.

The Bottom Line: Trust the System, Not the Salesman

The UAE has built one of the world’s most protective off-plan regulatory frameworks precisely because of past abuses. The Escrow Law is your shield. But a shield only works if you pick it up and hold it.

The scam persists not because the system is weak, but because fraudsters expertly exploit greed, FOMO (Fear Of Missing Out), and the investor’s reluctance to do boring, technical due diligence. They sell the sizzle, knowing you won’t check the steak.

Legitimate off-plan investment with reputable developers (Emaar, Nakheel, DAMAC, Meraas) is a core part of the market. But the difference between that and a scam is the difference between boarding a licensed aircraft and getting on a bus with “Fly to Dubai” painted on the side. One is governed by physics and regulation; the other is a vehicle for your catastrophe.

Your greatest defense is the understanding that if a deal seems too good to be true, it’s not an opportunity—it’s a test. And failing that test costs more than money; it costs faith.

Do not navigate off-plan due diligence alone. Our service includes a full developer viability report, contract review, and escrow verification. For less than the cost of a single installment, we can secure your entire investment.

👉 Click here to submit a project for our Off-Plan Risk Audit.