The Unbreakable Equation: Why Supply and Demand Isn’t Just a Theory Here

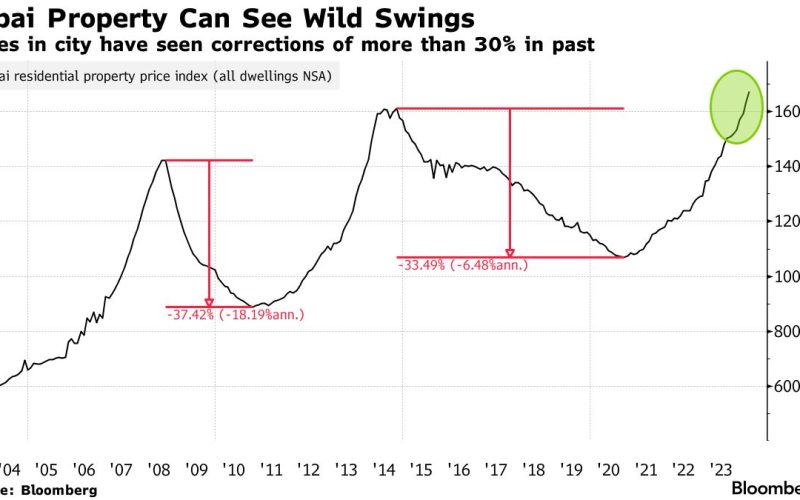

Stop listening to the doomsayers. Every few years, a chorus of “experts” emerges, pointing to cranes on the horizon and predicting Dubai’s real estate market is a bubble seconds from popping. They cite 2008.

They talk about over-supply. They warn of a looming crash. And yet, year after year, the market defies them. It corrects, it consolidates, and then it climbs again.

Why? Because these predictions are based on emotion and outdated anecdotes, not on the simple, brutal, and unassailable math that now governs Dubai’s property landscape.

The fundamentals have been permanently rewired by three non-negotiable factors: government policy, demographic gravity, and global capital flow. Let’s break down the equation.

The Three Variables in Dubai’s Anti-Crash Formula

1. Variable A: The Government as Master Architect (Not Spectator)

In most cities, the government reacts to the market. In Dubai, the government is the market’s primary architect. Its policies are deliberately designed to create a floor under prices and a ceiling over speculation.

-

The Supply “Drip-Feed”: Critics shout “oversupply!” but fail to see the mechanism. The Dubai Land Department (DLD) and the Real Estate Regulatory Agency (RERA) have near-total control over project registrations and off-plan sales launches.

-

They can, and do, slow the release of new land and licenses to pace supply with proven demand, preventing a catastrophic glut. This is a managed economy in action.

-

The Golden Visa Magnet: This isn’t just a residency permit; it’s a demand-generating machine. By offering 10-year renewable residency to property investors (over AED 2M), retirees, and high-skilled professionals, Dubai has created a permanent, growing class of resident-owners with skin in the game. They aren’t short-term flippers; they are long-term stakeholders adding stability.

-

The Speculation Tax (The Hidden Guardian): Look at the transaction costs. The 4% DLD fee + 2% agent commission (approx.) creates a 6% friction cost on every sale.

-

To make a quick profit, a property’s value must jump significantly just to break even. This automatically dampens the short-term “flip” culture that fuels bubbles and crashes elsewhere.

2. Variable B: Demographic Destiny (The Numbers Don’t Lie)

Population growth isn’t a hope; it’s a published plan with a track record.

-

The D33 Directive: The government’s Dubai Economic Agenda 2033 aims to double the size of the economy and make it a top 3 global city.

-

This isn’t propaganda; it’s a blueprint requiring an estimated +200,000 new residents per year in high-value sectors like tech, finance, and logistics.

-

These people need homes. This is structural, lease-signing, school-enrolling demand.

-

The Global Haven Effect: In a world of geopolitical tension and rising taxes, Dubai’s stability, neutrality, and 0% income tax act as a global vacuum for talent and capital. This migration is non-cyclical; it’s accelerating.

3. Variable C: The Shift from Speculation to Sovereign-Grade Asset

The market’s composition has fundamentally changed.

-

2008 vs. Today: The ’08 crash was fueled by excessive leverage and speculative, off-plan flipping by retail investors.

-

Today, a significant portion of premium purchases are all-cash transactions by UHNWIs, family offices, and sovereign funds buying trophy assets (AED 10M+ villas, branded residences).

-

This capital isn’t leveraged, and it isn’t emotional. It seeks a safe, tax-efficient, world-class harbor. This creates a massive, stable “core” in the market that is immune to interest rate swings.

The Simple Math: Putting It All Together

Let’s run the numbers with conservative estimates:

-

Government-Planned Demand: +200,000 new high-value residents per year (D33 target).

-

Average Household Size: Assume 2.5 persons per household.

-

New Households Annually: 200,000 / 2.5 = 80,000 new households needing accommodation.

-

Annual New Supply: Even in a “boom” year, Dubai delivers around 30,000-40,000 new residential units.

The Math: 80,000 households chasing ~35,000 new units. This is a demand-to-supply ratio of over 2:1 at the baseline, planned level. This doesn’t even account for the upgrading needs of existing residents or the global safe-haven capital.

This fundamental deficit, actively managed by policy and fed by immutable demographic trends, is why prices may stagnate or correct in certain segments (especially lower-quality, poorly located stock), but a system-wide, 2008-style crash is mathematically improbable.

The “Probably” Clause: The Only Real Threats

No market is invincible. The “probably” exists because of external, black-swan events that could temporarily override the math:

-

A Severe, Protracted Global Recession that halts international migration and capital flow.

-

A Dramatic Shift in Geopolitical Stability in the Gulf region.

-

A Sovereign-Level Policy Reversal (e.g., introducing property or income taxes), which is currently contrary to all stated strategy.

The Bottom Line: Not a Get-Rich-Quick Scheme, But a Get-Wealthy-Slowly Engine

Dubai real estate is no longer a casino. It has matured into infrastructure-backed, demographically-driven, policy-protected hard asset class. The math shows it’s built on a foundation of deliberately engineered scarcity and accelerating demand.

The promise isn’t of a crash-proof market where every property doubles in value yearly. The promise is of a market with a formidable floor and a long-term, upward trajectory, where quality assets in prime locations will continue to be coveted by a growing global pool of buyers who see Dubai not as a speculation, but as a sanctuary.

This math dictates that the real risk isn’t in buying, but in buying the wrong asset. In a market where quality will increasingly separate from the pack, your due diligence is everything.

We use data-driven models to identify properties that align with these fundamental growth drivers. For a analysis of which communities and asset types are positioned to thrive, request our market briefing.

👉 Download: “The Foundations of Growth: A 2025 Data-Driven Market Analysis”