The Green Fairway to Golden Returns

In a city defined by audacious verticality and hyper-modernity, an unexpected key to its most coveted real estate isn’t found in a penthouse view, but in a meticulously maintained stretch of green. Dubai’s world-class golf communities—Emirates Hills, The Address Montgomerie, Jumeirah Golf Estates, and Dubai Hills Estate—represent more than just luxury homes next to a sport. They are a unique, self-sustaining asset class that combines an aspirational lifestyle with remarkably resilient property values. For the player, they offer an unparalleled living experience; for the investor, they offer a “green premium” that has consistently outperformed the broader market through cycles of boom and correction.

The “Green Premium” Deconstructed: Why Golf Courses Drive Value

The premium attached to golf-facing or golf-community properties isn’t mere vanity. It’s rooted in powerful, tangible economic and psychological drivers that create a formidable “moat” around their value.

-

Scarcity and Permanence: A golf course is a massive, permanent greenbelt. It cannot be densified or redeveloped into towers, guaranteeing forever views, privacy, and a sense of space increasingly rare in a growing metropolis. This enforced low density creates an artificial scarcity that continuously supports prices.

-

The Lifestyle as an Amenity: Residents aren’t just buying a view of a fairway; they’re buying access to a country club lifestyle—fine dining, spas, tennis, pools, and social calendars. This transforms a home from a living space into a leisure and networking hub, a value proposition that appeals profoundly to high-level executives, entrepreneurs, and retirees.

-

Demographic Certainty: Golf communities naturally attract a specific resident: affluent, established, and often seeking long-term stability. This results in high owner-occupancy rates, well-maintained properties, and stable, quiet neighborhoods. For investors, this means reliable, high-quality tenants and lower turnover volatility.

-

The “Global Currency” of Golf: Dubai’s golf courses host European Tour events like the DP World Tour Championship. This global spotlight reinforces the prestige of the communities, tying local real estate value to an internationally recognized brand of luxury and sport. It ensures demand from a global, not just local, pool of buyers.

A Tour of Dubai’s Premier Golf Communities

| Community | Golf Course & Key Feature | Property Types | Lifestyle & Investor Vibe |

|---|---|---|---|

| Emirates Hills | The Montgomerie; Dubai’s original “Beverly Hills.” | Luxurious standalone villas on sprawling plots. | The established, low-key elite. Ultimate privacy and custom-built homes. Low turnover, very high capital values. |

| Jumeirah Golf Estates | Fire & Earth Courses (Home of the DP World Tour Championship). | A mix of high-end villas, townhouses, and premium apartments. | Sport-centric, vibrant, and international. Strong rental demand from golf enthusiasts and corporates. |

| Dubai Hills Estate | Dubai Hills Golf Club; part of a massive, integrated “city-within-a-city.” | Everything from apartments to grand villas, all new build. | Modern, family-focused, and amenity-rich. High growth potential as the community matures. |

| The Address Montgomerie | The Montgomerie Dubai; luxurious hotel-integrated living. | Apartments, townhouses, and villas with full hotel services. | Lock-and-leave luxury. Ideal for international investors wanting full-service, managed properties. |

| Damac Hills | Trump International Golf Club; more accessible price point. | Apartments, townhouses, and villas. | Value-oriented entry into the golf lifestyle. High rental yields, popular with young families. |

The Investor’s Scorecard: Assessing the Fairway

Not All Golf Communities Are Created Equal. When evaluating from an investment perspective, consider these key metrics beyond the view:

-

Developer & Management Pedigree: Is the community developed and managed by a tier-one name like Emaar (Dubai Hills, Arabian Ranches) or Meraas (more niche)? This dictates long-term maintenance quality and community value retention.

-

Rental Yield vs. Capital Appreciation: Communities like Damac Hills may offer stronger rental yields (6-7%), while Emirates Hills is a pure capital appreciation play with lower yields but higher absolute value growth.

-

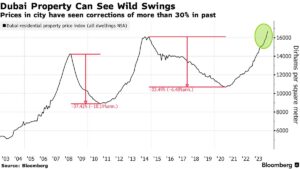

Liquidity: Established communities (Emirates Hills, JGE) have deep resale markets. Newer communities may have more volume but can be subject to greater price volatility from off-plan resales.

-

The “Beyond Golf” Amenity Mix: The most resilient communities (like Dubai Hills Estate) are anchored by golf but sustained by schools, hospitals, parks, and retail. This ensures demand even from non-golfing families.

The 19th Hole: Is It the Right Investment for You?

Buy in a Dubai golf community if:

-

You seek long-term capital preservation and steady appreciation.

-

You value lifestyle equally to financial return.

-

You are targeting a stable, high-net-worth tenant or buyer demographic.

-

You believe in the enduring appeal of low-density, green luxury.

Look elsewhere if:

-

You are chasing the highest possible short-term rental yield (look at central apartments).

-

You have a limited budget (entry points, even in value-oriented golf communities, are higher).

-

You prefer the energy of a dense, urban downtown environment.

The Final Verdict

Dubai’s golf communities are a masterclass in creating timeless value. They leverage a sport to build environments of lasting prestige, community, and scarcity. For the player-investor, they offer a rare synergy where your passion enhances your asset’s worth. In a market often driven by flash and speculation, the fairways offer a quieter, greener, and fundamentally more stable path to building generational wealth.

Choosing the right golf community requires matching your lifestyle goals with precise financial metrics. Our team specializes in the niche dynamics of Dubai’s premium lifestyle communities.